An Unbiased View of Estate Planning Attorney

An Unbiased View of Estate Planning Attorney

Blog Article

Estate Planning Attorney - Truths

Table of ContentsEstate Planning Attorney Things To Know Before You BuyAn Unbiased View of Estate Planning AttorneyAll About Estate Planning AttorneySome Known Details About Estate Planning Attorney All about Estate Planning AttorneyThe Ultimate Guide To Estate Planning AttorneyEstate Planning Attorney - An Overview

That you can prevent Massachusetts probate and sanctuary your estate from estate taxes whenever possible. At Center for Senior Citizen Regulation & Estate Planning, we understand that it can be hard to think and talk regarding what will certainly take place after you die.We can assist. Call and establish a totally free examination. You can additionally reach us online. Offering the greater Boston and eastern Massachusetts areas for over thirty years.

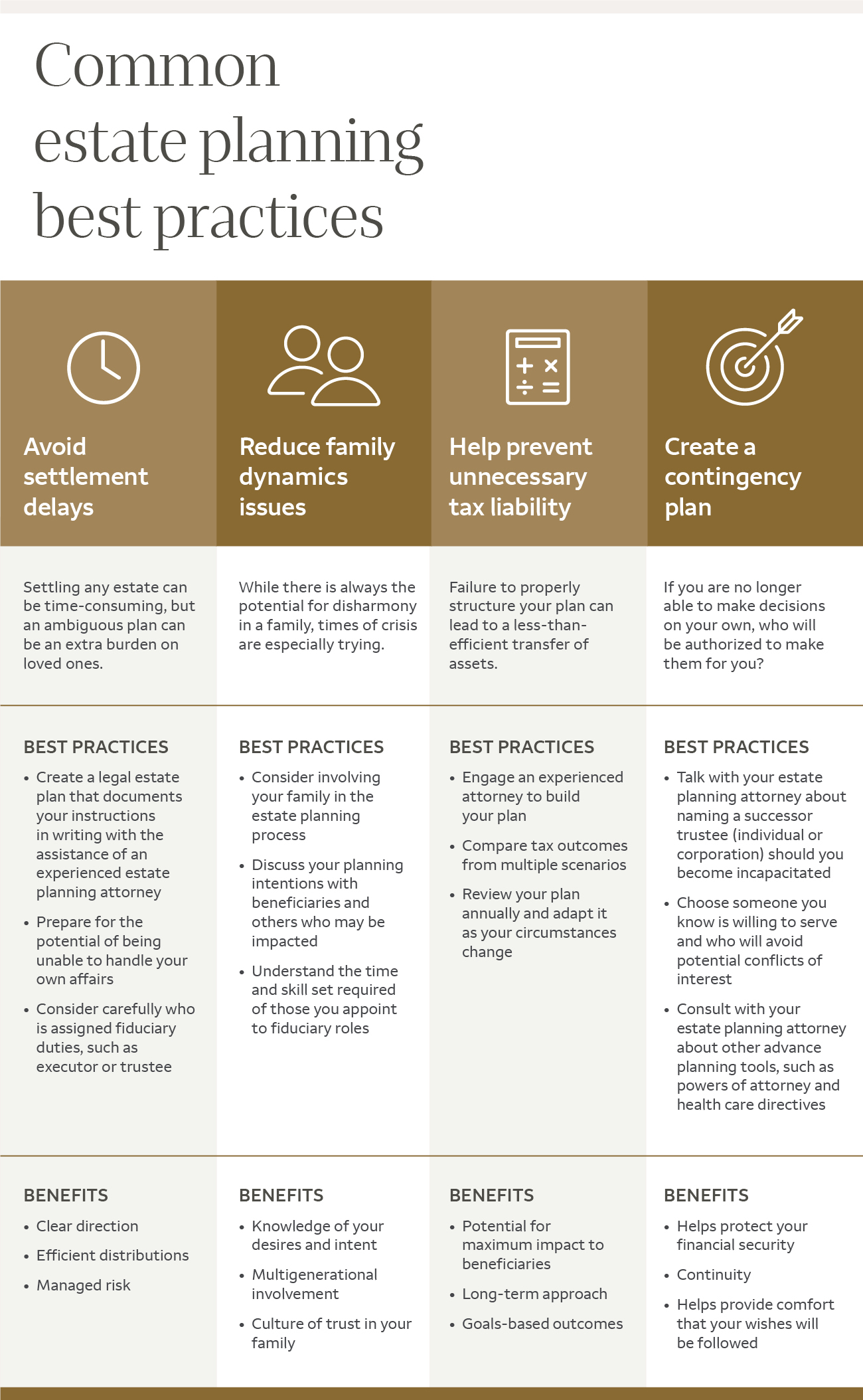

They aid you develop a thorough estate strategy that lines up with your desires and goals. Estate planning lawyers can aid you stay clear of errors that might invalidate your estate strategy or lead to unplanned effects.

The Best Strategy To Use For Estate Planning Attorney

Probate is a legal procedure that happens after someone passes away, where the court chooses just how their possessions are distributed. Working with an estate preparation attorney can assist you avoid probate altogether, saving time, and cash. An estate preparation lawyer can assist secure your assets from legal actions, lenders, and various other insurance claims. They'll develop a plan that guards your assets from possible risks and makes certain that they go to your designated beneficiaries.

To discover regarding actual estate,. To find out concerning wills and estate preparation,.

The age of majority in a provided state is set by state laws; generally, the age is 18 or 21. Some assets can be dispersed by the establishment, such as a financial institution or broker agent firm, that holds them, so long as the owner has given the proper guidelines to the monetary organization and has called the beneficiaries who will certainly get those possessions.

The Best Guide To Estate Planning Attorney

For instance, if a recipient is named in a transfer on fatality (TOD) account at a brokerage company, or payable on death (HULL) account at a bank or cooperative credit union, the account can usually pass straight to the recipient without going with probate, and hence bypass a will. In some states, a similar beneficiary classification can be included to property, enabling that property to also bypass the probate process.

When it involves estate preparation, a skilled estate lawyer can be an invaluable possession. Estate Planning Attorney. Dealing with an estate preparation lawyer can provide many advantages that are not readily available when trying to complete the process alone. From offering experience in legal matters to helping create a detailed plan for your family's future, there are numerous advantages of functioning with an estate preparation lawyer

Estate lawyers have considerable experience in understanding the nuances of various legal files such as wills, counts on, and tax legislations which enable them to supply audio recommendations on just how finest to secure your properties and guarantee they are given according to your desires. An estate attorney will also be able to provide advice on how best to navigate complex estate laws in order to ensure that your dreams are recognized and your estate is handled appropriately.

The Best Strategy To Use For Estate Planning Attorney

They can usually supply guidance on how finest to update or develop new records when needed. This might include advising modifications in order to benefit from brand-new tax advantages, or simply making sure that all relevant records reflect one of the most current recipients. These attorneys can also offer continuous updates associated with the administration of trust funds and various other estate-related matters.

The goal is always to guarantee that all documentation stays lawfully precise and shows your present desires accurately. A significant benefit of collaborating with an estate planning attorney is the very useful guidance they supply when it concerns preventing probate. Probate is the legal process during which a court identifies the legitimacy of a departed individual's will and supervises the distribution of their possessions in accordance with the terms of that will.

A knowledgeable estate lawyer can help to make sure that all needed papers remain in location and that any type of possessions are effectively dispersed according to the regards to a will, preventing probate entirely. Inevitably, working with a knowledgeable estate planning lawyer is among the finest means to ensure your want your family's future are accomplished appropriately.

They offer crucial lawful assistance to make sure that the most effective interests of any kind of small youngsters or adults with handicaps are totally safeguarded (Estate Planning Attorney). In such instances, an estate attorney will help determine appropriate guardians or conservators and make certain that they are provided the authority essential to manage the assets and events of their costs

Getting The Estate Planning Attorney To Work

Such counts on generally have provisions which shield benefits received through federal government programs while allowing trustees to keep restricted control over how assets are taken care of in order to maximize advantages for those entailed. Estate lawyers comprehend how these trusts job and can offer important assistance establishing them up effectively and making sure that they stay legally certified over time.

An estate preparation attorney can help a moms and dad consist of stipulations in their will for the treatment and management of their small children's possessions. Lauren Dowley is a skilled estate planning attorney who can assist you produce a plan that satisfies your specific requirements. She will collaborate with you to recognize your properties and how you want them to be distributed.

Do not wait check out here to start estate preparation! It is among the most essential things you can do on your own and your loved ones. With a bit of initiative, you can make sure that your last dreams are performed according to you. Contact Lauren Dowley today to obtain begun!.

The Buzz on Estate Planning Attorney

Producing or updating existing estate preparation records, consisting of wills, trust funds, healthcare regulations, powers of attorney, and associated tools, is one of the most crucial things you can do to guarantee your desires will be recognized when you die, or if you become incapable to handle your events. In today's electronic age, there is no lack of diy choices for estate planning.

Doing so can result in your estate plan not doing what you desire it to do. Wills, depends on, and other estate preparing documents must not be something you prepare once and never ever revisit.

Probate navigate here and trust fund laws are state-specific, and they do transform from time-to-time. Working with an attorney can provide you assurance understanding that your strategy fits within the specifications of state regulation. One of the greatest pitfalls of taking a diy approach to estate planning is the threat that your documents won't absolutely accomplish your objectives.

Examine This Report on Estate Planning Attorney

They will certainly think about different situations with you to prepare files that precisely reflect your wishes. One common misconception is that your will or trust fund instantly covers every one of your possessions. The truth is that certain sorts of property possession and recipient designations on assets, such as retired life accounts and life insurance policy, pass individually of your will or count on unless you this website take steps to make them collaborate.

Report this page